Andrew Taylor

March 2020

1. Why Was the Merchandising Practices Act Enacted?

A Brief History of the Act.

The Missouri Merchandising Practices Act (“MMPA” or “Act”) was enacted in 1967. Its fundamental purpose then, as it is today, was to protect regular consumers from deceptive business practices. The MMPA has necessarily evolved in the decades since it was enacted; in order to properly understand the Act, it is necessary to contemplate why it was passed in the first place.

Traditionally, the common law has provided for fraud claims in business dealings, including consumer transactions. A common-law fraud claim eventually became inadequate to protect ordinary consumers because: 1) such a claim required a number of elements to be proved, and 2) bringing such a claim potentially required the expenditure of significant resources in order to remedy a relatively small wrong.

The inadequacy of the common law in this regard should be viewed in the context of an evolving economy. The middle decades of the 20th century witnessed the rapid expansion and evolution of the U.S. consumer marketplace. Whereas consumerism in the decades and centuries before had typically involved transactions with local vendors, which assumed a relative balance of power between buyers and sellers, the expanding consumer economy entailed more mass production of increasingly complex products, such as TVs, refrigerators, and cars.

It was against this backdrop of increasingly impersonal and complex mass production, and decades after the federal government first addressed consumer protection in legislation, that Missouri’s legislature enacted the first version of the MMPA, in 1967. The initial iteration of the MMPA was relatively terse: it contained fourteen sections with § 407.020 providing the operative triggering language. That section significantly expanded the potential causes of action available to consumers in various ways, including the declaration that material and intentional omissions by sellers were now unlawful. This inclusion of passive deception—for example, the seller of a used car who knew the engine was fundamentally flawed need not explicitly lie about the engine but merely fail to mention it in order to be liable—entailed a significant advance in consumer protection because it addressed a sales tactic, especially pertinent to used cars, commonly used to deceive ordinary buyers.

Some industries, most notably advertising/marketing (including radio and TV stations), insurance, and regulated financial institutions have always been exempt from the MMPA. The logic behind their exclusion is clear: insurance and regulated financial firms, most relevantly regular commercial banks, are already subject to numerous state guidelines regulating various aspects of their businesses—even if they are not effectively regulated; in the case of advertising/marketing agencies and media stations, the logic of their exclusion is that they are not responsible for the practices of the businesses that merely pay them for publicity.

The 1973 Amendments

Perhaps the single most significant amendment to the Act occurred in 1973, when the legislature added a private cause of action to § 407.025, which also included the right to seek attorney’s fees and class actions. Before this crucial addition, consumer complaints had to be pursued by the Attorney General. In addition to adding a private cause of action, the 1973 amendments also explicitly addressed a practice—odometer tampering—commonly used to deceive buyers of used cars. One can also see a legislative response to a traditional consumer annoyance—door-to-door salespeople using high-pressure sales tactics—in the inclusion of a three-day right to rescission of credit-purchased personal goods and services stemming from unsolicited sales. The amendments also added some basic definitions, such as one for “commerce,” that the 1967 version of the MMPA had been remiss in failing to include.

The most seminal case in MMPA jurisprudence—State ex rel. Danforth v. Independence Dodge, Inc.—was decided in 1973 and concerned an automobile sale. In that case, prosecuted by Attorney General John Danforth, the court held that the defendant’s failure to disclose that a car billed as near-new had actually been in a wreck (of which the defendant had knowledge) was fraudulent behavior. The Danforth court also put forth a clear statement of the fundamental purposes of the MMPA:

The purpose of these statutes is to supplement the definitions of common law fraud in an attempt to preserve fundamental honesty, fair play and right dealings in public transactions. In order to give broad scope to the statutory protection and to prevent ease of evasion because of overly meticulous definitions, many of these laws such as the Missouri statute “do not attempt to define deceptive practices or fraud, but merely declare unfair or deceptive acts or practices unlawful.”

2. How Has the Merchandising Practices Act Adapted to Continuing Changes in the Marketplace?

The Evolution of the Act.

The 1985 Amendments

The next truly substantial amendments to the MMPA occurred in 1985. While the right to a private cause of action would probably be considered the most important addition to the Act relative to any given individual, the 1985 amendments may have been more expansive in aggregate, particularly with regard to scope of enforcement.

Significantly, the 1985 version of § 407.020 enabled the Attorney General to prosecute businesses for MMPA violations regardless of whether the businesses were domiciled in Missouri and utilizing unlawful practices against consumers outside the state or foreign and utilizing unlawful practices against Missouri consumers. Perhaps as significantly, the 1985 amendments also clarified that § 407.020 pertained to unlawful acts committed “before, during, or after the sale or advertisement”—thus, it became clear that jurisdiction over consumer fraud entailed a broad view relative to the advertising-to-sales consecution. The 1985 amendments also added the term “unlawful practice” so as to provide a definitional expansion capable of addressing a wider range of business practices, in keeping with the Federal Trade Commission Act.

The 1985 amendments, like others before and after, also included provisions targeting a particular type of industry or business practice; in 1985, this was the timeshare industry. As Webster et al. note, the “Time-Share Act” was enacted in response to the Attorney General’s realization of “a large increase in the number of complaints” relating to timeshare promotion and sales, with numerous allegations of “abuses, misrepresentations, and high-pressure sales tactics.”

Interestingly, the 1985 amendments also included a criminal provision, which currently reads: “Any person who willfully and knowingly engages in any act, use, employment or practice declared to be unlawful by this section with the intent to defraud shall be guilty of a class E felony.” While one can presume that Missouri prisons and jails are not teeming with inmates who have been convicted under the MMPA, this inclusion of a criminal provision clearly gave the MMPA sharper teeth with regard to bad-faith actors. As the highlighted words indicate, criminal charges require mens rea—the criminal provision is naturally intended for businesses who knowingly harm consumers in bad faith, not those who simply violate the civil provisions of the Act.

While the MMPA’s expansionary heyday was during the 1970s and 1980s, it continued to evolve slightly during the 1990s and into the 21st century. The triggering language—§ 407.020—and other key sections were amended multiple times during the 1990s and 2000s. These amendments generally reflected slight tweaks to the Act, particularly with regard to the state’s insurance and financial regulatory structure and the growth in telemarketing.

1990s

In 1992, in the immediate wake of the savings and loan crisis, the legislature added to § 407.020(2) language pertaining to the exemptions for insurance and regulated financial firms; specifically, it provided for the possibility that the legislature could enable via statute the Attorney General or private citizens with the right to sue otherwise exempt companies under the MMPA. In 1994, the same section was amended to reflect that the division of savings and loan was no longer an entity.

2000s

In 2000, Missouri’s legislature again perfunctorily amended § 407.020(2) to reflect that there was now a division of credit unions. It also addressed another industry/business practice that had generated undue complaints—telephone marketing—by creating a new set of laws under § 407 that specifically addressed that industry under the rubric of “Telecommunications Merchandising Practices” rather than the general language of § 407.020.

In 2008, the legislature amended § 407.020(2) yet again to reflect changes in the state’s regulatory-legal structure, including the specification of the statutory chapters under which chartered, licensed, or otherwise regulated business entities would find their exemptions from MMPA liability.

It is useful to state that, as should be evident based upon this brief history of the MMPA’s evolution, the MMPA has consistently responded to particular sub-industries that have often been notorious for predatory or high-pressure tactics. This has always included the shadier elements of used-car sales, but also nuisance businesses involving door-to-door sales, timeshare sales, fraudulent charitable solicitations, and telemarketing. In addition to persistent consumer issues with used-car sales, recent years have seen an uptick in subprime and payday lending activities.

Broadly, those who attack the MMPA as it currently exists have a tendency to, in a manner analogically similar to constitutional scholars that interpret according to original intent, operate under the maudlin impression that recent MMPA legislation and jurisprudence has strayed from the intent of the MMPA’s original framers. However, as has been described, the MMPA has long been a living statute geared towards an evolving marketplace and abuses. As the Danforth court averred in 1973, the MMPA intentionally avoided providing a specific list of proscribed acts because doing so would provide a fixed target that could be more easily manipulated by bad actors. Indeed, the greatest expansions in the MMPA occurred over thirty years ago and it is not at all evident that current applications of the Act have strayed far from the legislature’s original contemplation, whenever and whatever exactly that may have been.

3. Is the Missouri Merchandising Practices Act Still Important?

The Current State of the Act.

Is the MMPA still important? The short answer is absolutely. Indeed, the case can be made that, because of a combination of increased deployment and enforcement of arbitration agreements (which are usually contained in the fine print and probably favorable to business in aggregate), intensified subprime lending, complex and diffuse production of consumer goods across global supply chains, intensified debt collection and consumer reporting practices, and the general decline of the American middle class, the protections offered by the MMPA are as crucial as ever. In short, the core reasons behind the MMPA’s enactment clearly persist and new reasons justifying its broad construction have evolved in the decades since its enactment.

The MMPA Under Attack

Despite its importance to the ordinary Missouri consumer, the MMPA has been under attack recently by various Missouri legislators and the lobbies supporting them. The primary impetus behind the most recent iteration of this attack was ostensibly Joplin businessman David Humphreys, who was particularly upset about an MMPA case against his company. Aiding Humphreys in this attack was ATRA, law professor Joanna Shepherd, the Missouri Chamber of Commerce, and, obliquely, some research conducted by law professor Dr. Joshua Wright. This coalition, whether formal or informal, has tended to cite and rely upon the same small body of academic and quasi-academic work, which ultimately makes some rational recommendations for possible MMPA reforms but fails to address or adequately address numerous relevant issues.

The Inadequacies and Circular Support of the MMPA Attacks

To begin, Shepherd cites no meaningful evidence for the assertion that MMPA litigation costs in aggregate are “ultimately passed on to consumers through increased prices, fewer innovations, lower product quality, lower wages, and ultimately lower employment.” This is a sweeping statement whose only cited support is another Searle report that focuses exclusively on auto insurance premiums. Such a statement relies on numerous assumptions for which Shepherd offers no real support. Broadly, we are to accept, in the absence of any kind of robust distributional impact analysis, that Missouri has breached the optimal point of consumer litigation—that is, that the aggregate marginal costs of the MMPA as currently framed and interpreted exceed the marginal benefits—and is therefore costing itself the assured manna of job creation, lower prices, increased investment and innovation, et al. because of an aggregate deadweight loss induced by an overly permissive MMPA.

As Shepherd rightly points out, consumer law should strike an efficient balance between consumer protection and competition. However, she also posits a rhetorical strawman: “[t]his tradition of thoughtful and careful balancing balancing of interests has given way to harmful legislative and judicial over-corrections premised upon the misconception that additional consumer protection litigation necessarily protects consumers more.” Shepherd does not, and almost certainly cannot, provide a single relevant example of anyone who has concluded that more consumer litigation “necessarily” protects consumers more. Further, as will be noted throughout this critique, she fails to explain with any robustness or specificity why or how this supposedly untenable MMPA expansion has occurred decades after the 1973 and 1985 amendments that actually expanded the Act, passed during a time when legislators were supposedly more “thoughtful and careful” in their balancing of interests. Indeed, such a conclusion is completely unsupported—even by Shepherd’s own logic—a tactic common to those aimed at substantial tort reform, in Missouri and elsewhere.

In the absence of sufficient data and logical support, we are, in essence, to rely upon Chicago School-style (or, really, George Mason-style) truisms in a law-and-economics approach that has little to say about the realities facing Missouri consumers. Because a single St. Louis firm has been filing some number of allegedly meritless suits typically pertaining to food products, the MMPA has apparently fostered a bonanza for plaintiffs’ attorneys (who also happen to employ people, invest in operations, and spend money in Missouri) across the state to the general detriment of Missouri consumers. This premise, which seems to constitute the fundamental viewpoint of the ATRA and Chamber of Commerce, is poorly substantiated. Between Shepherd, the ATRA, and the Chamber of Commerce, we also receive no sense of how specific provisions within the MMPA, particularly those that are broadly being accused as being too expansive, relate to complaints filed, complaints dismissed, reported decisions, award amounts, and so on (let alone to actual effects on employment, investment, productivity, etc.)—i.e., we have no breakdown linking the alleged causes with the alleged effects and no distributions across case types, awards, plaintiffs and defendants, etc.

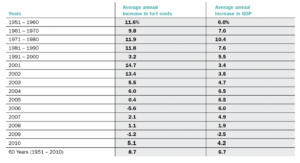

Noting that the most expansive amendments to the MMPA occurred in 1973 and 1985, Shepherd emphasizes the pronounced increase in Missouri consumer litigation during the years 2000-2009 as documented by the Searle Study’s preliminary report. Significantly, these data are unclearly, and possibly misleadingly and/or inaccurately, presented: Shepherd cites the Searle Study in claiming that Missouri “has been one of the worst offenders” with a claimed 677.8% growth rate in reported consumer protection decisions during 2000-2009. However, it is not evident where in the cited report, which lists Missouri as having a 39.6% compound annual growth rate (“CAGR”) in federal district courts during 2000-2007 and only a 2.2% CAGR in state appellate courts during 2000-2007, the underlying data come from. Shepherd states that the data are updated to 2009, which is presumably intended to depict a 10-year (2000-2009) absolute growth rate (with some CAGR raised to the appropriate exponent); however, it is completely unclear where the 677.8% figure comes from—supplementary data not actually made available in the cited study? Some combination of the stated CAGRs extrapolated to 2009? Cooper and Shepherd state that Missouri had the fifth highest growth, as measured by a CAGR of 14.6% between 2000-2013, in reported consumer cases, with most of that growth being in federal court. Because the use of a CAGR smooths over intertemporal volatility and because, as will be noted in the next paragraph, the financial crisis years saw a significant spike in federal litigation—which happened to be the key driver of MMPA litigation overall—the 14.6% rate, which does not even appear that remarkable, may have little relevance going forward. Anyway: which, if any, of these numbers are correct and, more importantly, what is their actual significance? Even if the 677.8% figure is somehow correct, it does nothing to break out federal versus state court decisions—seemingly a meaningful point of distinction if one wishes to address the Missouri taxpayer—and does not accurately reflect what is actually contained in the cited report. Indeed, as the cited Searle Study states, New Hampshire, Massachusetts, and Connecticut offered the most favorable expected value of recovery to potential plaintiffs—seemingly an important metric to consider when positing that excessive plaintiffs’ litigation is being unduly incentivized—during the period analyzed, with Missouri falling more towards the middle for 2004.

Again, one may note that the years 2007-2009 happened to coincide with the onset and immediate aftermath of the bad-mortgage-induced Great Financial Crisis, which may have had something to do with the steep growth in consumer litigation during that period, not just through the economic cyclicality of claims but the specific behaviors involved, most notably debt collection and subprime mortgage-lending. Indeed, as Cooper and Shepherd note, there was “a steep drop-off in federal litigation in the wake of the financial crisis, falling almost 25 percent from 2009-2010,” while the financial services industry has seen an outsized share of litigation since 2010. It bears mention that the supposed explosion in Missouri consumer litigation highlighted by the Searle data resulted in 31 reported decisions in federal district court and all of seven decisions in state appellate courts in 2007. Also, since it is now 2020, it may well be helpful if organizations like the ATRA and Chamber of Commerce would cite more contemporary (and robust) data.

There is also no ready explanation proffered as to why Utah, a state that is widely regarded as being quite business-friendly, was just behind Missouri (in Shepherd’s calculation) in terms of consumer litigation growth during 2000-2009. There are many more points of analysis—e.g., federal versus state court decisions and award amounts, dismissal rates and awards across jurisdictions within Missouri, clustering of decisions within given years (again, one should not be particularly surprised by an explosion in consumer litigation during 2007-2009 and use of a CAGR artificially smooths growth when it is uneven across periods), a meaningful breakdown of the industries/businesses involved in consumer litigation in Missouri, demographic and population-weighting—that go unaddressed in Shepherd’s overly conclusory short piece. It is also interesting that the Searle Study, which involved extensive data collection (that was also not particular to Missouri), was generally more qualified in addressing the implications of its data, noting significant limitations in that regard, than was Shepherd.

Further, seeming to have somehow concluded that like national data indicate that “the increase in consumer protection litigation is not likely the result of more dangerous products, more seller misrepresentations or demographic changes,” Shepherd offers no evidence to support this assertion and no explanation why it took decades for the Missouri plaintiffs’ bar to take undue advantage of the “indulgent” MMPA. As noted, the expansionary heyday of the MMPA occurred in the 1970s and 1980s. Likewise, Shepherd, citing Ports Petroleum Co., Inc. of Ohio v. Nixon (a 2001 decision), claims that Missouri courts have noted the “devolution” of the MMPA because, in Nixon, the court stated that the Act covers “every practice imaginable and every unfairness to whatever degree.”

This is a misleading spin, which seems to feed into the overall mythology being fostered, given the topic at hand: nowhere in Nixon did the court note anything resembling a “devolution” but rather it lamented that the phrase “unfair practice,” which had been used since the MMPA’s enactment, was, “for better or worse,” ambiguous when read literally. Even then, applying principles of statutory construction, the Nixon court decided against the Attorney General because it determined that the practice at issue had not actually harmed consumers such that the MMPA’s proscription of “unfair practices” did not apply. In essence, in Nixon the Attorney General had attempted to prosecute a gas station for dumping motor fuel by bootstrapping claims via the MMPA; the Missouri Supreme Court did not allow this. Nowhere in the case did the court note anything like a “devolution” in the MMPA; rather, it rightly noted that “unfair practice” is broad, albeit not insurmountable, and that an economic act explicitly prohibited by another regulation did not fall under the rubric of the MMPA.

Significantly, Shepherd and the ATRA provide no analysis of MMPA-related phenomena across jurisdictions within Missouri, which could presumably shed some light on their Missouri-specific contentions. For example, could the purportedly lax judicial interpretations that have led to such purportedly egregious consumer litigation be somehow related to a heightened rate of deceptive and predatory practices concentrated, in particular, in certain areas of St. Louis or Kansas City? Is it conceivable that certain jurisdictions are excessively lenient vis-à-vis the MMPA while others are stringent? Who are the “observers” who “say that the St. Louis Circuit Court, and Missouri state courts generally, are much less likely than their federal counterparts to dismiss such meritless claims”? Why is St. Louis allegedly so much more egregious than, say, Kansas City or Springfield? Are we even talking about problems with the MMPA as such or about defendants’ bar complaints about a particular circuit (the St. Louis Circuit) or even a specific judge or judges within that circuit?

Generally, Shepherd, the ATRA, and the Chamber of Commerce frame the issue of MMPA reform relative to the aforementioned self-selected set of supposedly absurd cases, usually concerning food products, in the context of St. Louis being a “judicial hellhole.” These are not representative of the median MMPA case, which would probably look more like a colorable claim against a used-car dealer. Like Chamber of Commerce head Dan Mehan’s emphasis on a particular candy suit (which was ultimately dismissed anyway), or discussion of the notorious McDonald’s-hot-coffee case in an introductory torts class, hyperbolic examples act more as soundbites and attention-grabbers for a passive audience than meaningful evidence with which to discuss policy. As Shepherd herself notes, “actual data on the number of frivolous cases is nonexistent”—nonetheless, she seems willing to extrapolate policy-oriented suppositions from some anecdotal data suggesting some amount of frivolous litigation. Likewise, she provides no citation for the assertion that “existing data suggest that this cycle has encouraged frivolous consumer protection lawsuits.” Without actual data on genuinely frivolous lawsuits, however defined, many of Shepherd’s arguments ring hollow for they ultimately rely on the conceptual notion that the existence of frivolous MMPA lawsuits render the Act suboptimal in aggregate and detract from job creation, innovation, product-quality improvements, and so forth.

Further, some of the cases that Shepherd and others cite as facially absurd—e.g., the cupcake mix case or the “free” upgraded Internet service case—may not actually be that absurd at all. While actual harm in such cases may well be debatable, why, for example, should a food company be allowed to advertise “all natural” ingredients if not all of its ingredients are natural? Why should Internet service providers, who typically provide an essential service in an oligopolistic market, be allowed to advertise speeds if they are not actually able to provide them? Why should consumers consistently pay for such misrepresentations rather than the businesses that make them?

It is as if those who attack consumer protection statutes on the basis of such cases take for granted that marketing claims like these entail harmless “puffery” rather than deception that can create real aggregate harms. Such cases may also establish useful precedent and not just be about compensating a given plaintiff for some marginal harm. For example, any number of consumers justifiably care about whether their food is organically grown and/or absent of GMOs, yet food is routinely mislabeled or deceptively labeled in this regard; why should companies be allowed to deceptively market their foods and what benefits are being induced by allowing them to misleadingly market their products?

Arbitration and Spokeo

At the national level, the Supreme Court has issued multiple decisions in relatively recent years—the most notable being AT&T Mobility LLC v. Concepcion and Spokeo, Inc. v. Robins—that tend to limit the ability of consumers to sue companies in the public courts. Concepcion concerned the inclusion of a binding arbitration provision, a practice that has furtively affected the legal rights of millions of U.S. consumers. Generally, if a consumer is bound by an arbitration agreement they will be compelled out of the public courts and into private arbitration, which can expedite the litigation process but also results in an almost total lack of transparency that favors business. The increased use and enforcement of arbitration clauses, which often include class-action waivers, have had the predictable effect of chilling consumer class actions. Even though there is good reason to believe that Congress never intended the Federal Arbitration Act (“FAA”)—the 1925 legislation that the Supreme Court relied upon in Concepcion—to apply to the consumer (or labor) context, which generally does not entail the same symmetry in negotiating power as does the commercial context, a 5-4 Supreme Court majority held that California’s determination that class-action waivers in arbitration agreements were unenforceable under certain conditions was preempted by the FAA. Frequently, agreements with arbitration clauses also contain forum-selection and choice-of-law provisions, which determine where the arbitration will be held geographically and what law will apply. For example, a credit card company based in South Dakota or Utah may well specify in a user agreement that South Dakota or Utah law shall apply even if the consumer lives in another state. Such provisions generally benefit businesses by enhancing the predictability of arbitration outcomes and, of course, by allowing them (if they can reasonably do so) to select jurisdictions with statutes less friendly to consumers.

Interestingly, the lawsuit against TAMKO that so inflamed Humphreys involved a Missouri court’s refusal to enforce an arbitration provision. Humphreys’ apparent derision of the MMPA was largely misplaced, for the dispositive issue in the case was whether the plaintiffs had accepted the arbitration provision simply by purchasing a bundle of shingles in which a fine-print copy of the warranty and arbitration clause were included; the plaintiffs had also failed to receive a copy and were not made aware of the arbitration provision. The court properly held that the plaintiffs could not be compelled to arbitrate because a copy of the arbitration provision happened to be contained within the bundle they purchased. Therefore, the Humphreys-funded attack on the MMPA was either completely misplaced and blindly retaliatory or he ultimately believed that the plaintiffs should not have had a cause of action at all even though the shingles they purchased with a 30-year warranty allegedly began to fail after a much shorter period. If the latter is true, then perhaps Humphreys believes that Missouri should not have a consumer protection statute of all. Of course, all this may well have been avoided if TAMKO had simply agreed to honor the plaintiffs’ warranty claims in full.

The Supreme Court in Spokeo, which concerned a technical violation of the Fair Credit Reporting Act without an allegation of the actual harm (“injury in fact”) required for Article III standing, disagreed with the circuit court’s assessment that the plaintiff had sufficiently alleged facts so as to establish standing and remanded the case. Cooper and Shepherd note that Spokeo “may go some way toward establishing an injury requirement,” which was ultimately their core recommendation for consumer law reform (the demonstration of actual harm). While Spokeo, as a 2016 decision, is fairly recent with still uncertain mass effects, it would facially seem to address directly any concern with undue litigation over merely technical violations—i.e., some sort of unlawful practice that did not result in any actual harm.

Regardless, an analysis of the state of Missouri consumer law that fails to address, in particular, arbitration agreements, as well as the many lawsuits filed against consumers by, in particular, financial entities in the public courts (with the companies often able to compel arbitration if the consumer counterclaims), is incomplete if it purports to actually care about the condition of the Missouri consumer. Obviously, the expansion of consumer arbitration, including prevalent class-action waivers (the MMPA has its own class-action requirements), and the standing requirement asserted in Spokeo do not mean that the MMPA is optimal or that it should be construed so as to compensate for other difficulties consumers face—this is neither rational nor the function of law. However, the narrow and largely unsubstantiated conclusions, as discussed above, put forth by Shepherd and the ATRA also cannot be considered in isolation if they actually purport to care about the overall welfare and rights of consumers.

Reality for many ordinary consumers (in Missouri and nationally), in keeping with the finding of Cooper and Shepherd noted above, entails increasing debt levels, recourse to payday lending and other high-interest sources of liquidity, increased exposure to subprime auto-lending (longer loan periods at high interest, often for cars that will soon require repairs), more expansive (and often aggressive) debt collection schemes, the constant threat of identity theft, and consumer reports that may take years or even decades to correct when they contain an error. Put simply, if the MMPA were to be gutted (as was proposed by Missouri Senate Bill No. 5), that, in combination with the ability of many companies who do business in Missouri—particularly large ones with boundless resources and sophisticated legal teams—to compel arbitration, make use of public courts only when seeking declaratory judgments, generally exploit barriers to collective action, and perhaps to press standing issues (according to Spokeo as well as Twombly/Iqbal), could assure that Missouri consumers collectively continue to lose power relative to businesses, especially large corporations. Of course, the presumed response to all this would be that an “expansive” MMPA and related litigation hurt Missouri consumers collectively while overwhelmingly aiding plaintiffs’ attorneys almost exclusively—there is simply no real evidence of this assertion provided in the Shepherd/ATRA pieces beyond the anecdotal or conceptual. While it is easy enough to take this assertion as a truism based upon, say, a set of class actions wherein the plaintiffs’ attorneys receive a large payment while individual plaintiffs receive very little, there is no overt evidence that this is the case in aggregate.

Missouri Senate Bill No. 5

In 2017, a Missouri legislator—Ron Richard, a Joplin Republican, presumably acting at the behest of Humphreys—sponsored provisions within Senate Bill No. 5 (“SB5”) that would have drastically altered the MMPA. Unsurprisingly, SB5 attempted to gut the MMPA rather than reform it in a rational, tailored manner. This is unsurprising given that its sponsorship appeared to be retaliatory in nature rather than based upon rational investigation and discourse.

Crucially, SB5 attempted to completely revise § 407.25 and add extremely limiting language that would have placed crushing, undue burdens of proof upon consumer plaintiffs. It would have also repealed the possibility of punitive damages, completely deferred to the policies of the Federal Trade Commission, and made requirements for class certification more onerous. Gratefully, certain Missouri legislators—a Republican and a Democrat—sniffed out the pay-to-play motivation behind the MMPA evisceration contained in SB5, which helped kill it. However, because of lobbying by organizations like the ATRA and conservative businesspeople and donors, the specter of continued attacks on the MMPA remains very much alive.

Missouri Senate Bill No. 591, ATRA, and the Perryman Report

Like clockwork, another big-business-friendly tort reform effort has, furtively, emerged in Missouri: Senate Bill No. 591 (“SB 591”). Again, it is a Joplin Republican sponsoring the bill—in this case, Bill White. The evident primary target of SB 591 appears to be punitive damages, although it also targets the MMPA.

With regard to punitive damages, SB 591 wishes to turn back the clock and require establishment of intent before punitive damages may be awarded—this simply encourages bad actors to cultivate plausible deniability. Under the current standard, punitive damages may be awarded if “reckless indifference”—roughly equivalent to gross negligence—is established with great certainty; this, in itself, is not an easy bar to meet. Nonetheless, the corporate-backed politicians who drafted SB 591 want Missouri citizens to, in effect, be required to uncover “smoking guns” in order to be granted punitive damages. Needless to say, such smoking guns evincing intent rarely exist. Rather, more common is a defendant who had reason to know that a given action would harm a person and yet took that action anyway—of course, there is no recorded statement averring that the defendant intended to harm the individual. Rather, even if it is clear that the action was reckless, or perhaps even likely intentional, clear intent is an extremely high bar to meet and, again, facially allows bad actors to repeat harmful actions over and over as long as they are deemed merely negligent, not intentional.

With regard to the MMPA, SB 591 attempts to subtly gut the MMPA, often in a manner that would escape the eye of a layperson. For example, it adds language that would allow damages only for a plaintiff where the alleged unlawful conduct “would cause a reasonable person to enter into the transaction . . .”—this appears to be “reliance” language that could make it extremely difficult for a plaintiff to collect damages even if they were undeniably wronged. As a hypothetical example: your Internet service provider charges you a small monthly fee—say, of $5—that was not theretofore disclosed or agreed to; assuming you are a “reasonable person,” would the disclosure of such a small fee have caused you to purchase Internet service from one of, say, another of just two other providers? Who knows—what does it mean to “cause” one to enter a transaction? Under the revised MMPA, however, it may well be okay for that company to charge such a fee many times over and not be held accountable for such because a “reasonable person” may have still subscribed to the service. Likewise, it is, arguably, probable that such language would greatly constrain claims for material omissions—such as that failure to disclose a small monthly fee, or the failure of a landlord to disclose that a building’s HVAC system was so incredibly inefficient as to lead to markedly higher utility bills, or the failure of a car dealer to disclose that the “new” car you just purchased had actually sustained structural damage while being taken on a test drive—how can the conjectural “reasonable person” reliably prove that but for the existence of the omission they would not have entered the transaction? Even further, a transaction-based definition facially absolves merchants from liability for post-transaction conduct—this is, put simply, terrible public policy. Regardless, SB 591 overtly wishes to put the onus on consumers—those who typically possess less information than sellers—for the wrongdoing of merchants.

ATRA, upon the passing of SB 591, tweeted a citation to the dollar figures generated by the Perryman Report; these unsubstantiated findings were regurgitated by others. As will be discussed at length in Appendix A, any legislator would be irresponsible in relying upon the Perryman Report, which may be making the rounds despite being wildly inadequate as any sort of serious policy instrument, let alone a robust economic analysis. The mere fact that someone paid for the Perryman Report is cause for concern and, given that the same report was effectively auto-generated for a number of other states, further demonstrates that the current attack on the MMPA is little more than part of a poorly concealed national campaign being waged from Washington, D.C.

Appendix A:

The Perryman Report

M. Ray Perryman—a consultant who produces reports under the guise of being an “academic”—seems to be the most recent marginal “expert”-for-hire engaged by lobbyists in their current campaign to roll back consumer protections. Perryman—located in Waco, Texas—has apparently farmed out copies of his reports, based on his own opaque, self-maintained models, to various “red” states; these reports are essentially copy-and-pastes of one another. It takes only some ordinary Internet research to discover that Perryman is skilled primarily at self-promotion—he sells copies of his half-baked reports to, mostly, Texas interests and is no way a widely recognized economist—at least not in the ordinary, complimentary sense. Indeed, essentially every quote about him is recycled from . . . Perryman himself. This particular analysis is of Perryman’s report, Economic Benefits of Tort Reform: An Assessment of Excessive Tort Costs in Missouri and Potential Economic Benefits of Reform (“Perryman Report”), although it appears, facially at least, that it may as well be a critique of all Perryman’s reports. The Perryman Report is so shoddy, misleading, and irresponsible as to require its own explanation here. For example:

- Essentially every important conclusion in the Report stems from Perryman himself—i.e., his “models” were built by him and are maintained by him and there is no evidence that they have been seriously peer reviewed—ever.

- Multipliers—“knock-on effects,” effectively, in common parlance—are essential to framing the costs and benefits of a structural economic changes, including, to some extent, proposed tort reforms . . .

- Perryman has utterly neglected to actually delineate his calculation of such critical measures; rather, on page 13 Perryman provides a simple narrative account of how multiplier effects are generally important to such an analysis and how tort reform in Ohio has somehow provided a reliable benchmark for such reforms in other states.

- Perryman’s key conclusion (at page 1) that the annual direct tort costs from excessive tort costs in Missouri are $2 billion is facial nonsense—linguistically, definitionally, and empirically. First, are these net costs? This critical point would not be neglected by a serious economist purporting to present a cost-benefit analysis of reforms entailing (supposedly) billions of dollars. This point is crucial: one does not just add up “costs” for something called “torts” and then remove them from the economy without actually detailing the dynamic, net effects of such . . .

- Second, stating that costs are “excessive” presupposes that some analysis has already been performed—i.e., that these costs are excessive because they exceed some optimal amount. Nowhere in the Report is there such an analysis . . .

- Third, merely stating that $2 billion in “excessive tort costs” result in $2 billion in “direct costs” is, to say the least, awkwardly phrased, possibly tautological, and, naturally, completely unsubstantiated . . .

- Fourth, Perryman, just as crucially, does not actually define what “tort” costs entail in any meaningful way—what are they? Are they actually costs stemming directly from the legal tort system or do they, for example, include unrelated insurance premiums or insurance disputes that are not litigated?

- Likewise, Perryman somehow concludes that these supposedly excessive tort costs result in $3.1 billion in lost annual output for Missouri; here we see the aforementioned multipliers—silently, in the background, and completely unsubstantiated—resulting in a shockingly large number.

- Perryman repeatedly cites the U.S. Chamber Institute for Legal Reform (“ILR”) in the report—despite its somewhat neutral-sounding name, this is a lobbying organization; no serious economist would meaningfully rely on such input. Likewise, the Report cites the Pacific Research Institute and Federalist Society—Perryman essentially just gathers citations from random libertarian sources. Again, it is entirely obvious that he does not act as an economist.

- Perryman completely misrepresents work done by Towers Watson, an ostensibly neutral and well-regarded consulting firm . . .

- On page 5 of the Report, Perryman attempts to shock us with the growth of “tort costs” in the United States since 1950—this chart is effectively meaningless . . .

- First, this graph is objectively incorrect—the Y-axis is labeled in hundreds of millions of U.S. dollars times “millions of nominal U.S. dollars”—this should be “thousands of nominal U.S. dollars” . . .

- Second, these are nominal—i.e., not real, not inflation-weighted—dollars. No serious economist would present such a chart without weighting it for inflation and/or comparing it to nominal GDP growth or a similar measure of national economic growth . . .

- The reason why Perryman selected to misrepresent the Towers Watson data on page 5 is, as noted above, fairly obvious—BECAUSE THAT DATA EVIDENCED THAT TORT COSTS HAVE GENERALLY BEEN DECLINING RELATIVE TO GDP FOR DECADES:

- The Perryman Report inexplicably uses Ohio as a benchmark for proposed tort reforms in a number of other states—this, too, is prima facie nonsense. Would, for example, Missouri enact the exact same reforms that Ohio did? Why would the purported economic effects of Ohio’s reforms be a reliable indicator for Missouri’s? Perhaps most importantly, why would anyone trust Ray Perryman to have accurately calculated the actual economic effects of Ohio’s legal reforms?

- The Report likewise shows a complete deficit of understanding of how legal frameworks interact with political economy. Perryman, citing the ILR, states on pages 5-6 that “the U.S. had the highest liability costs as a percentage of GDP among the advanced economies . . . [t]hese findings suggest that the resources consumed by the tort system in the US are well above the level required to maintain an efficient and productive economy.” That finding suggests no such thing. Besides different countries and regions possessing legal frameworks that are derived from embedded values, histories, and institutions, all of those advanced economic areas possess marginally larger welfare states—i.e., socioeconomic “safety nets”—than does the United States. In the U.S., plaintiff’s litigation, particularly class actions, consistently acts as a kind of check on corporate interests that evolved differently in varied areas of the world. There is no reason to believe—at least not one based on ample evidence—that there exists some kind of optimal per capita global tort cost.

- As for the “tort tax”: it seems that Perryman has just taken his own spurious $3.1 billion in GDP figure and simply divided it by Missouri’s population.

- The states to which Perryman apparently farmed out his reports (at page 9)—Alabama, Mississippi, West Virginia, Arkansas, and Texas—further expose Perryman as little more than a regional shill for hire. These include four of the six poorest states in the country and not one of them is known as plaintiff-friendly.

- Perryman is most evidently not a lawyer and the Report’s inability to distinguish between, for example, federal versus state frameworks across causes of action and lawsuit outcomes, punitive judgment standards, or medical malpractice versus product liability versus consumer litigation further weakens what was already a shockingly weak paper.

- Perryman’s claim (at p. 21) that his regional model is “extensively used by scores of federal and state governmental entities on an ongoing basis, as well as hundreds of corporations” is almost certainly nothing more than another self-promoting misrepresentation.

- Generally, one is hard-pressed to find any work by Perryman in an actual academic journal; rather, he cites largely to himself.

In short, the Perryman report is a house of cards built on self-referencing sand; its conclusions are borderline worthless and cannot withstand even moderate scrutiny without far more explanation. In sum, given that Perryman’s work is so overtly unsubstantiated, deceptive, and shoddy, the important question really is:

WHO PAID FOR THIS “REPORT” AND WHY?

For source information, click here for the full document: MMPA-History-2020.01..docx